Archive

Toronto Condo Foreign Buyers

One of the hottest topics in real estate circles in Canada these days is the proportion of offshore buyers, and if and how they are inflating prices in local markets. This month, the Canada Mortgage and Housing Corporation has released a report which investigates the extent of foreign ownership in the condominium markets of Canada’s major cities. One of the interesting stats to come out of the report is that foreign ownership of condos tends to be higher in newer buildings – those built since 2010 in the cities of Toronto and Vancouver.

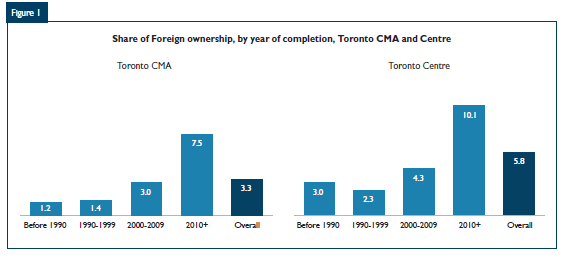

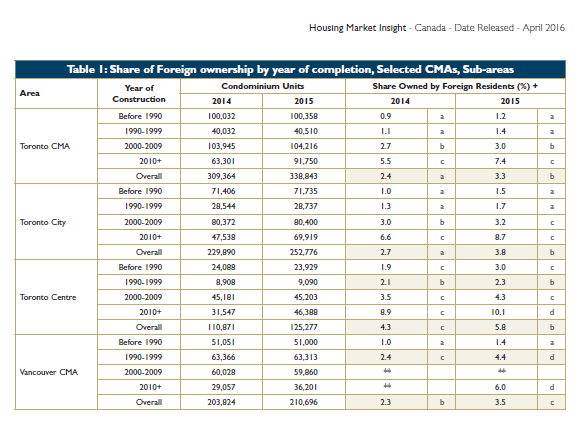

CMHC reports that the rate of foreign ownership in the overall Greater Toronto Area (CMA) is less than 2% for condominium projects completed before 1990, but foreign ownership rises to 7% for condos completed since 2010.

For Toronto, foreign ownership of condos is highest in the downtown core of the city, where the numbers approach 10%. CMHC does note that the methodology used for their study allows for some leeway in the exactness of the numbers.

The foreign ownership totals are higher in Toronto, somewhat surprisingly, than they are in the Vancouver area, where foreign investors count for less than 2% of the projects built before 1990, a number which increases to about 6% for those completed since 2010.

Also interesting to note, there are some fairly large statistical jumps from 2014 to 2015 – for example, in the overall Toronto CMA, foreign ownership of condos in that single year jumped nearly a full 2 percentage points – from 5.5% to 7.4% – for buildings completed 2010 or later. It’s important to remember, however, that some of these numbers can be skewed by condo construction completions, and when there are a large number of completions in a single year, the foreign ownership numbers will grow correspondingly. The growth in foreign ownership of condos, nevertheless, as shown by these CMHC statistics, is obviously real , and hard to ignore.

So what are we to make of foreign ownership of condos, and how does it affect our local market in the Greater Toronto Area? I think that the numbers are still relatively low, although certainly 10% foreign ownership of newer condos in the downtown core of Toronto will have a effect on the market. Toronto’s growing role as a global city brings added pressures on real estate market pricing, it’s a simple matter of supply and demand. That new offshore investors are most interested in newer projects indicates that attention is being paid to many of the latest condo project launches, many of which are being marketed globally. It appears that the word is getting out there that Toronto, and its environs, are a good, stable, and safe place to invest. Going forward, I believe this trend will continue.

Top 100 Neighborhoods to Invest in Canada

Top 100 Neighborhoods to Invest in Canada

Mississauga was recognized as one of the Top 100 neighborhoods to invest in Canada, in the recently published annual investment guide put out by Canadian Real Estate Magazine. I was asked to contribute to the article, and in it we review three separate areas of Mississauga – Clarkson, Cooksville, and Meadowvale Village. In the guide we review detailed information on population, population growth, vacancy rates, cap rates, average price, average rent, and projected cash flow.

Canadian Real Estate Magazine puts out this special issue every year to provide investors with comparative information for cities across Canada. See the video here:

Clarkson

Clarkson has been selected as a good place to invest due to several reasons. It is an older area, where the price of housing is a bit less than some of the newer areas of Mississauga. It nevertheless has an excellent location, with close proximity to the QEW highway, the Clarkson GO station, as well as good schools and shopping. One profitable strategy for investors in Clarkson has been to purchase semi-detached homes with a separate basement apartment. This way, the investor benefits from two streams of income – one from upstairs, and one from downstairs.

Cooksville

Cooksville, along with Clarkson and Meadowvale, was one of the original towns which were amalgamated to form the City of Mississauga. Cooksville is centered near Dundas and Hurontario streets, the old intersection known as 5 + 10. It is also an older area, with pockets of reasonably priced homes that attract good rents. Cooksville may also benefit if the planned and fully funded Hurontario LRT is eventually built. As it is today Cooksville is ideally located near the QEW highway, and features Trillium Hospital, a major employer and source of good tenants.

MeadowVale Village

Meadowvale Village is situated in the extreme northern edge of Mississauga, and has great connectivity to Pearson Airport, highway 401, and the major employment areas which surround the airport. Once again, for the investor we recommend the semi-detached house, with a separate basement apartment, for an ideal source of two streams of income.

These are just three neighborhoods in Mississauga which we are highlighting in Canadian Real Estate Magazine. There are many other options for anyone looking to invest in real estate, including excellent opportunities with condos in the Square One area. For much more information, see my main site here: www.randyselzer.com

Elle Condos – Mississauga

Elle condos, along with its sister towers Eden Park and Eve, comprise a group of luxury condominium towers that were recently completed by Amacon Corporation of Vancouver, B.C. Situated just south of the bustling Square One area of Mississauga, Elle is a 31 storey high rise condo, with a matching podium. Elle features the handsome modernist style of architecture that is also found on its sister towers Eden Park, and Eve. Together they form a visually striking trio in the Mississauga City Centre core. Municipal address for the Elle condo is 3525 Kariya Drive.

Residents of Elle can enjoy an impressive list of features and amenities provided by the condo – 24 hour concierge, indoor swimming pool, whirlpool, sauna, gym, workout room, BBQ area, and much more. One of the best features of the Elle condo is its location, situated just a few minutes walk from the 300+ store Square One shopping mall. Being in the heart of the city, there is no shortage of dining and entertainment options, and public transit is literally on the doorstep of this condo.

Visit my main site for a detailed profile and review of the Elle condo Mississauga.

Mississauga Square One Condo Investing – Impact of Sheridan College

On December 15th, 2009 official groundbreaking took place for phase one of the new Sheridan College campus at Mississauga Square One. The new college facility is being built under the Federal-Provincial Infrastructure Stimulus Funding program, and as such, the 150,000 sq. ft. building must be completed by March 31, 2011. Some 1,700 students will attend classes when the school opens in the fall of 2011, including 1,200 business students, plus there will be 560 spaces for new Canadians who are being retrained to enter the workforce. Actual construction will commence in February, 2010, and is being managed by Bird Construction.

The campus will be located on an 8.5-acre parcel of land, just north of the Living Arts Centre, between Prince of Wales Dr. and Rathburn Rd. W. and will include such features as a pedestrian bridge, open parkland and a traffic roundabout.

When phase two of the campus is built after 2011, there will be room for 5,000 students.

How will this new campus impact condo investment in the Mississauga City Centre (MCC)?

Well, the news is all good. Vacancy rates are currently low in the MCC area, despite all the new developments recently completed. And the addition of 1700, and later up to 5000 university-age students in the immediate area will only add to the pool of available renters. Current large projects in the sales stage, such as Amacon’s Parkside Village, should see a sales boost from this new campus. We predict a decline in rental vacancy rates once the campus is up and running, with the potential for a firming of rental rates.

Investors looking for long term potential gain in the Mississauga Square One city centre area should look upon the addition of the Sheridan College campus as a major windfall.